In recent years, Bitcoin — the world’s first and largest cryptocurrency — has moved beyond retail speculation and institutional funds into corporate treasuries. A growing number of publicly traded companies are allocating a portion of their balance sheets to Bitcoin, treating it as a strategic reserve asset similar to cash or gold.

This trend reflects broader corporate confidence in Bitcoin’s long-term store of value, inflation hedge properties, and global digital liquidity. Many firms believe holding BTC can diversify treasury risk, signal innovation leadership, and appeal to investors who are bullish on digital assets.

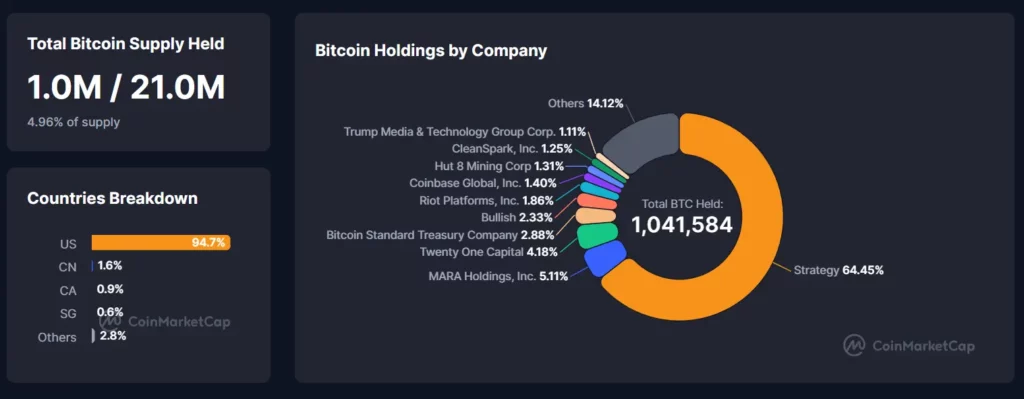

According to ongoing tracking by CoinGecko and BitcoinTreasuries.net, public companies collectively hold hundreds of thousands of BTC, representing a meaningful share of Bitcoin’s total fixed supply.

Why Companies Are Holding Bitcoin?

Public companies typically hold Bitcoin for several strategic reasons:

1. Reserve Diversification

Bitcoin can act as a hedge against inflation and fiat currency risk. Instead of keeping cash reserves in traditional assets, some companies view BTC as a modern diversification tool.

2. Institutional Validation

Corporate balance sheet adoption boosts Bitcoin’s legitimacy in traditional markets, encouraging other institutions to consider digital assets.

3. Long-Term Growth Bet

Firms with a long-term view on Bitcoin’s adoption and price potential see BTC holdings as an appreciating asset, potentially yielding significant capital gains over time.

4. Brand and Market Positioning

Companies that embrace Bitcoin can position themselves as innovative leaders in finance and technology — appealing to both retail and institutional investors.

Risks and Challenges

Despite advantages, corporate Bitcoin treasuries come with unique risks:

- Volatility: Bitcoin prices can swing significantly, potentially impacting quarterly earnings and stock valuations.

- Regulatory Uncertainty: Governments continue to refine cryptocurrency regulations globally, which can affect how Bitcoin is taxed or classified on balance sheets.

- Liquidity Considerations: Large purchases or sudden sell-offs could affect market dynamics.

Top 10 Public Companies Bitcoin Treasuries (2025)

Below is the latest Top 10 list of public companies by Bitcoin holdings, based on publicly available treasury disclosures and tracking data as of late 2025.

| Rank | Company | Ticker | BTC Holdings | Approx. USD Value |

|---|---|---|---|---|

| 1 | Strategy Inc. (formerly MicroStrategy) | MSTR | ~638,460 | ~$73.6B |

| 2 | MARA Holdings | MARA | ~52,477 | ~$6.05B |

| 3 | Twenty One Capital (XXI) | XXI | ~43,514 | ~$5.02B |

| 4 | Bitcoin Standard Treasury Company | BSTR / CEPO | ~30,021 | ~$3.46B |

| 5 | Bullish | BLSH | ~24,000 | ~$2.77B |

| 6 | Metaplanet Inc. | 3350.T | ~20,136 | ~$2.32B |

| 7 | Riot Platforms | RIOT | ~19,309 | ~$2.23B |

| 8 | Trump Media & Technology Group | DJT | ~18,430 | ~$2.13B |

| 9 | Galaxy Digital | GLXY | ~17,102 | ~$1.97B |

| 10 | CleanSpark | CLSK | ~12,827 | ~$1.48B |

Data estimates reflect reported holdings and the approximate market value of BTC. Figures may vary with price fluctuations.

Notable Leaders

Strategy Inc. remains the undisputed leader in corporate Bitcoin treasuries, far ahead of its peers. With hundreds of thousands of BTC on the balance sheet, its holdings dwarf those of other public companies by a significant margin, reflecting a decades-long strategy pivot toward digital assets.

Mining and Investment Firms such as MARA Holdings, Twenty One Capital, and Bitcoin Standard Treasury specialize in accumulating BTC through mining profits or direct purchases, contributing robustly to their treasury portfolios.

Emerging Corporate Holders like Trump Media and Bullish exemplify the expanding diversity of firms adopting Bitcoin — extending beyond mining and tech into media and financial platforms.

The Future of Corporate Bitcoin Treasuries

The corporate adoption of Bitcoin shows no sign of slowing. As more public companies embrace BTC as part of long-term financial planning, the trend could influence Bitcoin’s supply dynamics and price discovery mechanisms. Market watchers expect continued integration with traditional finance, potentially accelerating institutional participation.

However, as BTC allocation strategies become more mainstream, companies must balance innovation with prudent risk management — ensuring that large holdings align with long-term financial health and shareholder expectations.

Frequently Asked Questions (FAQs)

A Bitcoin treasury strategy refers to a company allocating a portion of its balance-sheet reserves into Bitcoin instead of holding all funds in cash, bonds, or other traditional assets. Companies adopt this strategy to diversify reserves, hedge against inflation, and gain exposure to Bitcoin’s long-term growth potential.

Public companies buy Bitcoin for several reasons:

1. To protect purchasing power against inflation

2. To diversify treasury assets beyond fiat currencies

3. To benefit from potential long-term price appreciation

4. To signal innovation and forward-thinking financial management to investors

As of 2025, Strategy Inc. (formerly MicroStrategy) holds the largest Bitcoin treasury among public companies, with over 600,000 BTC, making it the most prominent corporate Bitcoin holder globally.

Yes, corporate Bitcoin holdings come with risks such as:

1. High price volatility affecting quarterly earnings

2. Regulatory uncertainty in different jurisdictions

3. Accounting and taxation complexities

However, companies that adopt Bitcoin typically do so with a long-term perspective and structured risk management.

Bitcoin holdings can influence stock prices positively or negatively, depending on market sentiment. When Bitcoin prices rise, stocks of BTC-heavy companies often gain investor interest. Conversely, sharp BTC price declines may create short-term pressure on share prices.

Yes. Bitcoin mining companies often accumulate BTC as part of their operations. Instead of selling mined coins immediately, many miners retain Bitcoin on their balance sheets, effectively building a corporate Bitcoin treasury.

In principle, yes. Any public company can allocate funds to Bitcoin as long as it complies with:

1. Local financial regulations

2. Shareholder disclosure requirements

3. Accounting standards

Board approval and transparent reporting are usually required.

Corporate Bitcoin treasuries are tracked using:

1. Public financial filings

2. Company press releases

3. Blockchain analysis

4. Dedicated tracking platforms like Bitcoin treasury dashboards

This ensures transparency for investors and regulators.

Many analysts believe corporate Bitcoin adoption will continue to grow as:

1. Institutional acceptance increases

2. Regulatory clarity improves

3. Bitcoin becomes more integrated with traditional finance

However, adoption speed will vary by region and industry.

No. Bitcoin is not replacing cash entirely. Instead, it is being used as a complementary reserve asset, alongside cash, bonds, and other investments, to enhance diversification and long-term value preservation.

I am Pawan Kashyap currently living in Amritsar. I always try to grab new things from the cryptocurrency market. From my observations and trends in the market, I always try to provide the best and accurate information in the form of articles from this blog. Follow us on Facebook, Instagram, and Twitter to join us.