CMC Bitcoin Halving 2024: Countdown to Reduced Block Rewards

As we approach April 2024, a significant event looms in the world of cryptocurrency. The block reward for Bitcoin mining will be halved from 6.25 Bitcoin per block to 3.125 Bitcoin per block, as meticulously tracked by our countdown clock.

Understanding the Bitcoin Halving

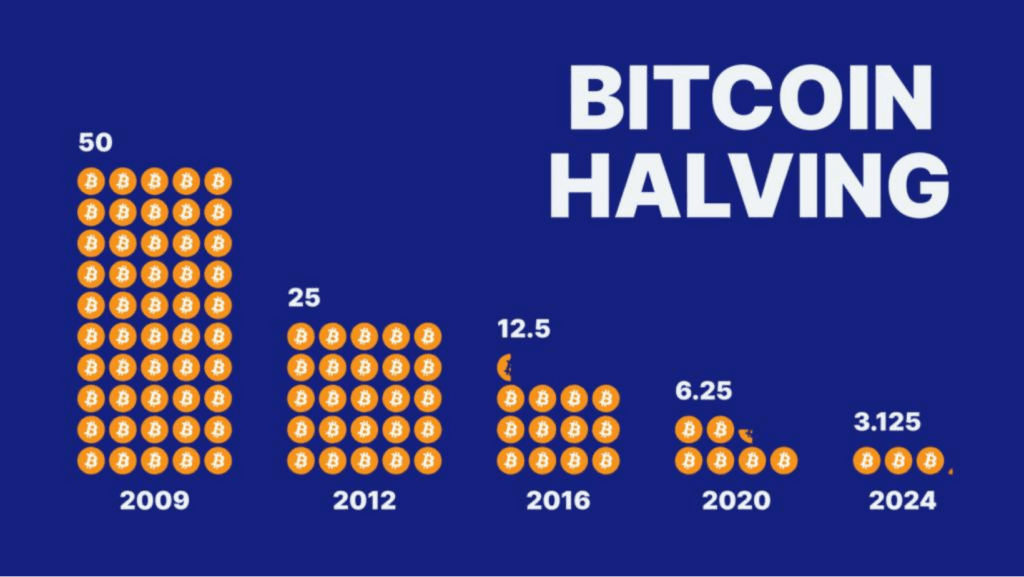

The Bitcoin Halving is a pivotal, pre-programmed event that slashes the reward given to crypto miners by half approximately every four years. This reduction is crucial to maintaining the balance of Bitcoin’s supply and preventing inflation. With fewer coins awarded to miners, the demand for Bitcoin is anticipated to surge, potentially driving up its value. This event occurs roughly every 210,000 blocks, or about every four years, with the most recent halving taking place in May 2020, which reduced the reward from 12.5 to 6.25 BTC per block. The Bitcoin Halving plays a vital role in ensuring the long-term viability and scarcity of Bitcoin.

Reflecting on Past Bitcoin Halvings

The Bitcoin block reward undergoes a halving every 210,000 blocks, or roughly every four years. This systematic reduction in Bitcoin’s inflation rate is commonly referred to as the “halving.”

November 28th, 2012: The Inception

BTC Price: $12.20

The first halving marked the halving of the initial 50% of the Bitcoin mining reward – from 50 to 25 Bitcoins per block. During this time, the impact of the halving wasn’t fully priced in, with the community anxiously observing. Despite concerns, the subsequent months saw the network hash rate and difficulty decline as less profitable miners scaled back operations to manage costs.

However, by early 2013, Bitcoin embarked on its inaugural major bull run, soaring from $13 to over $1,000 by year-end. This demonstrated that fears of miner capitulations were largely unfounded, highlighting the bullish nature of halvings on the Bitcoin network and its price.

July 9th, 2016: Bracing for Impact

BTC Price: $640.56

The second halving witnessed another 50% reduction in the block reward – from 25 to 12.5 BTC. With memories of 2012 still fresh, the community anticipated another bullish trend driven by the halving. While some cautioned about potential negative impacts on mining profitability and the network, what followed exceeded expectations.

Bitcoin experienced an astounding bull run in 2017, reaching nearly $20,000 by year-end, propelling cryptocurrencies into the global spotlight. This set the stage for an even more substantial bull run four years later.

May 11th, 2020: Setting New Grounds

BTC Price: $8,605

The third halving once again halved the mining reward, paving the way for yet another anticipated bull run. Speculation swirled around growing institutional adoption and Bitcoin as a hedge against inflation.

Following the halving, Bitcoin’s price surged once more, with the community prepared and anticipating the subsequent bull run, which materialized remarkably in 2021. Many now foresee a repetition of history in 2024.

2024 and Beyond

BTC Price: $25,764 (September 7th, 2023)

The upcoming halving will once again slash the mining reward, this time to 3.125 BTC per block. The Bitcoin community eagerly awaits this milestone, expecting it to further heighten Bitcoin’s scarcity and, optimistically, initiate a new bull market.

Bitcoin’s inherent halvings serve as a distinctive feature, providing predictable control over its supply issuance. While other cryptocurrencies have attempted to replicate this model, none have achieved the same success in inflation reduction as Bitcoin.

Critics may argue that halvings are unnecessary, suggesting that Bitcoin’s supply could have been capped at 21 million with all units released immediately. However, Satoshi Nakamoto’s foresight recognized the significance of gradual, rule-based issuance in fostering adoption and fairness. Indeed, Bitcoin owes much of its current status to halvings.

Moreover, halvings forge connections across Bitcoin generations. Those who experienced the 2012 halving have witnessed the community’s growth and milestone achievements. Conversely, newcomers post-2020 look to earlier halvings for context on Bitcoin’s origins. Halvings serve as reminders of the journey taken and the path ahead.

The halving is hardcoded into Bitcoin’s protocol to regulate the supply and inflation rate, ensuring a predictable inflation rate and establishing Bitcoin as a scarce asset.

The halving halves miners’ profits in terms of coins, potentially shrinking profit margins if prices do not rise. This incentivizes miners to innovate and make mining more energy-efficient and decentralized over time.

Halvings occur every 210,000 blocks, roughly every four years based on the 10-minute average block time, rather than on specific dates.

There have been three halvings so far: November 2012: Block reward decreases from 50 to 25; July 2016: Block reward decreases from 25 to 12.5; May 2020: Block reward decreases from 12.5 to 6.25.

Historically, Bitcoin’s price has tended to increase following halving events. While it is challenging to predict prices for 2024 and 2025, many believe that the 2024 halving could initiate a new bull market.

A decrease in supply, with constant or increasing demand, typically drives prices higher according to basic economic principles. While various factors influence asset prices, many attribute significant impact to halvings when making price predictions.

Anticipation of halving events and their potential impact on supply can be priced in beforehand, leading to speculation and volatility. Investors may buy Bitcoin ahead of halvings, anticipating price increases, contributing to market fluctuations.

I am Pawan Kashyap currently living in Amritsar. I always try to grab new things from the cryptocurrency market. From my observations and trends in the market, I always try to provide the best and accurate information in the form of articles from this blog. Follow us on Facebook, Instagram, and Twitter to join us.